At the moment in the Netherlands you can deduct the interest you pay on your mortgage from your taxable income, provided you meet certain conditions – and have the right type of mortgage.

How much you can claim depends on your income and in general, the more you earn, the more you can deduct. The government is gradually reducing this: If you pay tax at the highest rate, the deduction was reduced to 43% this year and will go down again to 40% in 2022.

But while there are lots of different sorts of mortgage available in the Netherlands, only two allow you to subtract your mortgage interest payments from your taxes. These mortgages are the annuity mortgage (annuïteitenhypotheek) and the linear mortgage (lineaire hypotheek).

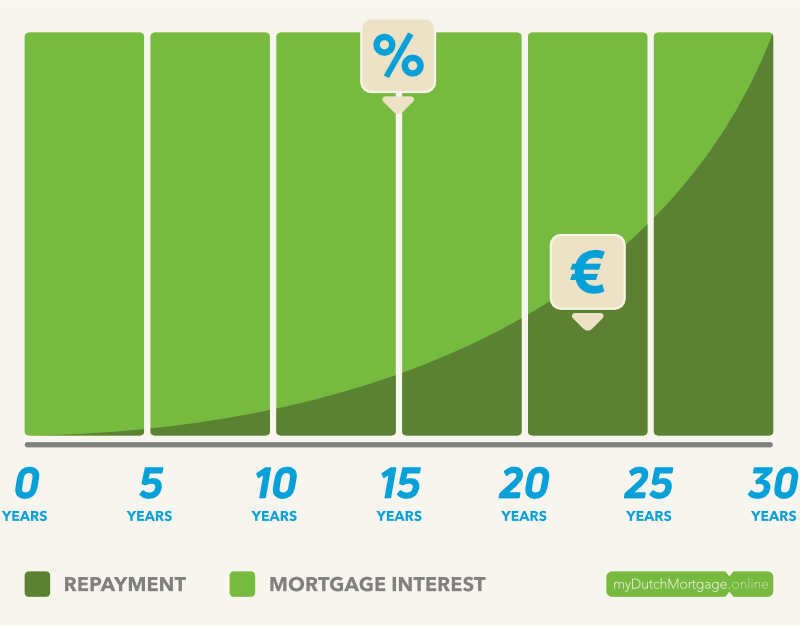

An annuity mortgage, also known as a repayment mortgage, is the most common type of mortgage. The lender works out the amount you need to repay each month to clear your mortgage by the end of an agreed term. Your monthly repayment is made up of two parts:

In the early years, most of your repayments will go toward paying off interest on your mortgage. But as your mortgage reduces, the interest part of the repayment goes down. So as time goes on, more of your monthly repayments go toward paying off the capital.

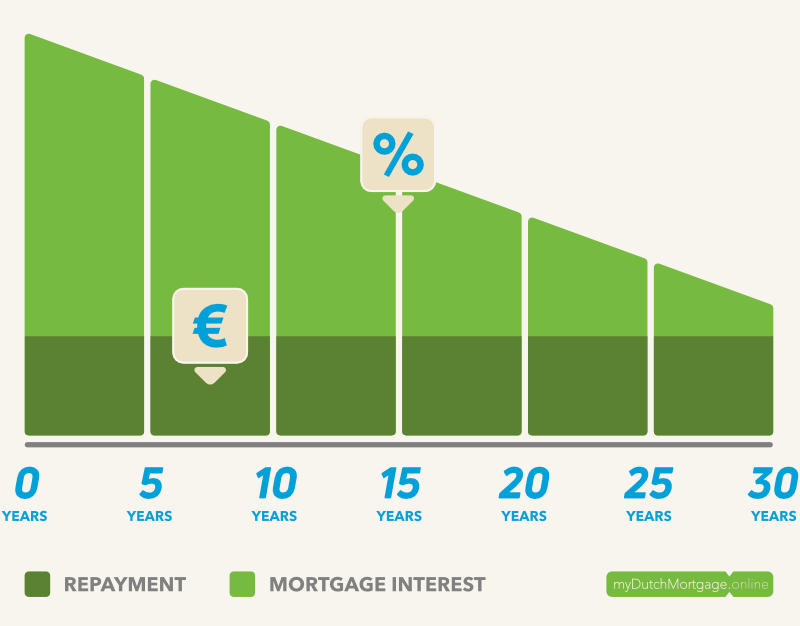

The linear mortgage repayment is made up of two parts:

With a linear mortgage, you repay the mortgage loan by a fixed amount every month. On top of this you pay interest, but the interest payments will reduce over time since you are gradually paying off the mortgage loan.

There are several other types of mortgages in the Netherlands but, remember, you won’t qualify for a tax break if you use them.

For more on the different types of mortgage available in the Netherlands, check out the housing dictionary on MyDutchMortgage.online